General Insurance for Individuals

Insuring your personal assets, your personal home or your legal responsibility towards third parties doesn’t have to be complicated. Our local and experienced team is at your service to identify and set up adequate solution. We also provide claims assistance when needed.

General insurance protects individuals and families against losses, damages, or liabilities. It will provide you with financial aid to help you manage your situation through unpredictable events. Certain policies offer protection in case of theft, accidents, or other disasters. They ensure that you can replace or repair property covered by the policy in a timely manner.

In case of an accident, you might be entitled to cover third-party losses. General Insurances can provide you with solutions taking care of costs that occurred in any unforeseen events.

Travel Insurance

Protect you and your family against unexpected events such as personal accident, medical expenses overseas, travel delay, loss of personal belongings.

Home Insurance

Protect your home against any unforeseen events. Besides covering your home contents, you could also include your family's legal liability due to accidents in your home.

Motor Insurance

Drive with greater peace of mind with the most appropriate insurance plans to suit your motoring needs.

Personal Accident Insurance

Protect you and your family with suitable personal accident plan against accidental injuries and common infectious diseases.

Maid Insurance

For many families, the domestic helper is an invaluable help. Take care of your helper by providing protection in the event of accidents and illness.

Golf Insurance

Enjoy your game without having to worry about injury, loss or damage to your equipment or accidents to third party.

Others

If you are not able to find the coverage for your specific needs, please contact us for further assistance.

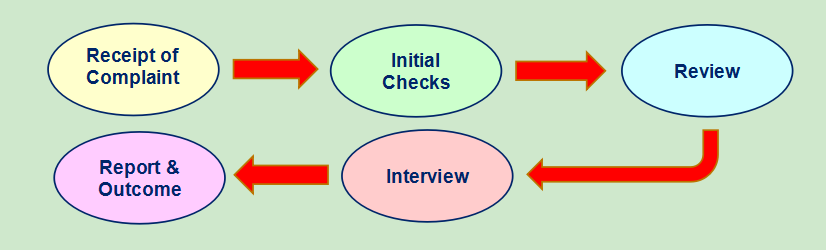

Compliance will work towards providing a final response to the complainant within 20 business days. If the case turns out to be of a nature that is complicated or even complex that requires an extension of time, which is likely to take beyond the 20 business days after receipt of the complaint, Compliance will send a request of extension of time to the relevant party.

Compliance will work towards providing a final response to the complainant within 20 business days. If the case turns out to be of a nature that is complicated or even complex that requires an extension of time, which is likely to take beyond the 20 business days after receipt of the complaint, Compliance will send a request of extension of time to the relevant party.